ESG, SDG and COP27 are just some of the acronyms you would have seen in news headlines and articles, but what do they stand for and why are they important to investors? In this article, we take a deep dive into sustainability to understand the biggest challenges facing our planet today and why it matters to the investment process.

From Hurricane Ian in the US to the summer heatwaves across Europe, it is hard to miss the headlines on climate change. Closer to home, the typhoons in the Philippines and devastating floods in Pakistan are stark reminders of how vulnerable our region is to weather-related disasters.

Southeast Asia was singled out by the Intergovernmental Panel on Climate Change (IPCC) as one of the planet’s most vulnerable regions to climate change. Our region is home to 450 million and this is the harsh reality: sea levels are rising faster than elsewhere, and shorelines are retreating in coastal areas.1

In the next 30 years, Brunei is likely to experience an increase at a rate of 0.4 degrees Celsius per decade. An intensifying trend in total rainfall is also expected. All these changes in weather patterns will impact our local biodiversity, further making wildlife vulnerable.2

The United Nations chief has labelled the new UN weather report on the intensifying state of global warming as a “chronicle of chaos”, and this comes as the global community gathered in Sharm el-Sheikh in Egypt in November for the COP27 climate conference.

COP or the Conference of the Parties is the key decision-making forum of the UN Framework Convention on Climate Change (UNFCCC), whose mission is to reduce greenhouse gas emissions and address climate change.

Brunei is making progress to reduce its carbon footprint. In 2020, the country committed to a 20% reduction of greenhouse gas emissions by 2030. Last year at COP26, Brunei pledged to hit net zero by 2050. And this year, the government has made it mandatory for industrial greenhouse gas emitters to report their carbon footprint.

Southeast Asia was singled out by the Intergovernmental Panel on Climate Change (IPCC) as one of the planet’s most vulnerable regions to climate change. Our region is home to 450 million and this is the harsh reality: sea levels are rising faster than elsewhere, and shorelines are retreating in coastal areas.1

In the next 30 years, Brunei is likely to experience an increase at a rate of 0.4 degrees Celsius per decade. An intensifying trend in total rainfall is also expected. All these changes in weather patterns will impact our local biodiversity, further making wildlife vulnerable.2

The United Nations chief has labelled the new UN weather report on the intensifying state of global warming as a “chronicle of chaos”, and this comes as the global community gathered in Sharm el-Sheikh in Egypt in November for the COP27 climate conference.

COP or the Conference of the Parties is the key decision-making forum of the UN Framework Convention on Climate Change (UNFCCC), whose mission is to reduce greenhouse gas emissions and address climate change.

Brunei is making progress to reduce its carbon footprint. In 2020, the country committed to a 20% reduction of greenhouse gas emissions by 2030. Last year at COP26, Brunei pledged to hit net zero by 2050. And this year, the government has made it mandatory for industrial greenhouse gas emitters to report their carbon footprint.

A roadmap for the future

Climate change is now too big to ignore. In recent years, it has resulted in sustainability moving to the forefront of investors’ agendas but what started out as prioritising the planet has evolved to focussing on societal and governance issues.

ESG stands for environmental, social and governance. When it comes to making an investment decision, investors now consider these three factors and whether a company has prioritised them. The financial performance of organisations is increasingly affected by ESG factors.

Environmental considerations include climate change and carbon emissions, biodiversity, energy efficiency and water scarcity. Social spotlights the internal and external stakeholders, and how companies deal with trends like including gender and diversity, community relations, customer satisfaction and human rights. Finally, governance is about oversight and transparency, and includes board composition, executive compensation, bribery and corruption, and political contributions.3

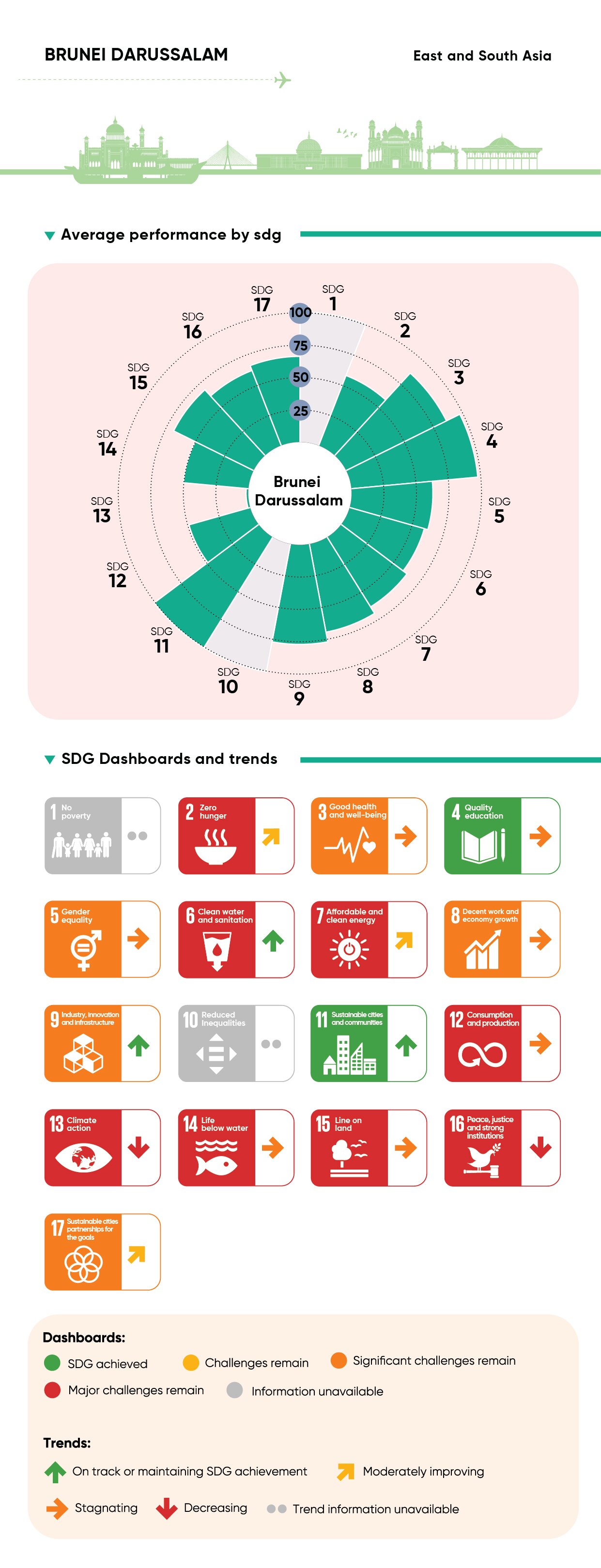

SDGs or Sustainable Development Goals are part of the United Nations 2030 Agenda for Sustainable Development. Adopted by the UN member states in 2015, it is a shared blueprint for peace and prosperity for people and the planet. The series of 17 goals range from zero hunger and gender equality to climate action, and the deadline for completion is 2030.

ESG stands for environmental, social and governance. When it comes to making an investment decision, investors now consider these three factors and whether a company has prioritised them. The financial performance of organisations is increasingly affected by ESG factors.

Environmental considerations include climate change and carbon emissions, biodiversity, energy efficiency and water scarcity. Social spotlights the internal and external stakeholders, and how companies deal with trends like including gender and diversity, community relations, customer satisfaction and human rights. Finally, governance is about oversight and transparency, and includes board composition, executive compensation, bribery and corruption, and political contributions.3

SDGs or Sustainable Development Goals are part of the United Nations 2030 Agenda for Sustainable Development. Adopted by the UN member states in 2015, it is a shared blueprint for peace and prosperity for people and the planet. The series of 17 goals range from zero hunger and gender equality to climate action, and the deadline for completion is 2030.

According to Brunei’s Special National Coordinating Committee, Brunei Darussalam made a solid achievement in 2022 to maintain and advance the sustainability of some concerned areas as the nation recovered from the pandemic.

Many companies use the SDGs to define their ESG framework. Baiduri Bank, for example, has implemented several ESG initiatives. From waste reduction programmes to supporting diversity and inclusion (D&I) efforts, ESG allows the bank to address the risks and opportunities that can impact future performance.

Why ESG investing matters

The COVID-19 crisis has accelerated the ESG agenda. According to an Ipsos poll conducted globally for the International Monetary Fund, 43 percent of those surveyed said they were more worried about climate change now than before the pandemic. Many have said the pandemic is a “wake-up call” to preserve our planet.

As tough as lockdowns were on the population, the shutdown of cities caused a reduction in air pollution in most countries. In China’s capital cities where air quality is often a challenge, the lockdowns resulted in a sharp reduction in severe air pollution. That improvement had a surprising result in reducing thousands of pollution-related deaths.4

But the environment is just one part of it, the pandemic also brought to light. social and governance issues like employee safety and well-being, income and wealth disparity as well as the resiliency of supply chains.

More needs to be done to protect our planet and its people. As an investor, you can influence where your money is going and demand accountability from the companies that you invest in. This in turn will encourage countries and companies to implement the ESG changes necessary to protect the planet and its people.

As tough as lockdowns were on the population, the shutdown of cities caused a reduction in air pollution in most countries. In China’s capital cities where air quality is often a challenge, the lockdowns resulted in a sharp reduction in severe air pollution. That improvement had a surprising result in reducing thousands of pollution-related deaths.4

But the environment is just one part of it, the pandemic also brought to light. social and governance issues like employee safety and well-being, income and wealth disparity as well as the resiliency of supply chains.

More needs to be done to protect our planet and its people. As an investor, you can influence where your money is going and demand accountability from the companies that you invest in. This in turn will encourage countries and companies to implement the ESG changes necessary to protect the planet and its people.

Thinking about getting started on your ESG investment journey?

If you still have questions, look out for our second article that looks at what ESG investing is about and how you can invest in solutions that are transforming our world. You can also reach out to the team at Baiduri Capital for more questions. Reach them at +673 226 8588 (during office hours) or [email protected]

Baiduri Capital office hours:

Monday to Thursday: 9:00am – 5.00pm

Friday: 9:00am - 12:00pm and 2:00pm - 5:00pm

Saturday, Sunday and Public Holiday: Closed

1https://www.weforum.org/agenda/2021/08/southeast-asi-weather-extremes-global-warming-2030-ipcc-report/

2http://www.climatechange.gov.bn/SitePages/Pages/Home.aspx

3https://www.cfainstitute.org/en/research/esg-investing

4https://medicine.yale.edu/news-article/in-china-strict-quarantine-improves-air-quality-and-prevents-thousands-of-premature-deaths/

2http://www.climatechange.gov.bn/SitePages/Pages/Home.aspx

3https://www.cfainstitute.org/en/research/esg-investing

4https://medicine.yale.edu/news-article/in-china-strict-quarantine-improves-air-quality-and-prevents-thousands-of-premature-deaths/